Financial services marketing is entering a decisive phase. What worked even two or three years ago is starting to show cracks, and financial firms or wealth planners that don’t adapt intentionally in 2026 are going to feel that gap fast.

As a financial services marketing agency working closely with advisors, planners, and firms across the industry, we’re seeing patterns emerge. The firms gaining traction aren’t necessarily doing more marketing; they’re doing smarter marketing that aligns with how people actually search, evaluate, and build trust today.

So if you were our client, here’s what we’d tell you to prioritize heading into 2026.

1. Embrace AEO Now or Prepare to Fall Behind Quietly

Over 60% of Google searches now end without a click, largely due to AI summaries, featured snippets, and instant answers.

SEO still matters. But Answer Engine Optimization (AEO) is quickly becoming just as critical, especially in financial services.

Prospects aren’t just typing keywords into Google anymore. They’re asking full questions in AI tools, voice search, and search summaries:

- “How do I choose a financial advisor?”

- “What does a wealth planner actually do?”

- “Is this firm right for someone like me?”

If your content isn’t structured to answer those questions clearly, you won’t show up, even if your firm is reputable and well-established.

In 2026, financial firms should prioritize:

- Clear, question-based website content

- FAQ-driven service pages

- Educational blogs written in plain language

- Content that mirrors how clients speak

Any marketing teams for financial advisors that aren’t actively planning for AEO is already behind.

2. Video Is a Trust Requirement, Especially for the Next Generation of Wealth

We hear this hesitation a lot:

“Our clients don’t want video.”

“Our advisors aren’t comfortable on camera.”

What we’re seeing in practice tells a different story.

Video has become one of the fastest ways for prospects — especially millennials and the next generation of wealth — to decide whether they trust you before they ever reach out. In fact, 73% of consumers say short-form video is their preferred way to learn about a product or service, including professional services.

Short, simple video works because it:

- Humanizes advisors

- Explains complex topics quickly

- Builds familiarity without a meeting

- Fits naturally into social and search platforms

And no — this doesn’t mean flashy, overproduced content or market commentary that creates compliance headaches.

In 2026, effective video looks like:

- Educational explanations

- “Here’s how we think about this” insights

- Advisor perspective, not predictions

- Authentic, professional, low-pressure delivery

Relevant reading: Why Financial Planners and Wealth Managers Need to Market to Younger Generations

3. Generic, Canned Content Doesn’t Cut It Anymore… Personalization Wins

This is one of the biggest shifts we’re seeing across the industry.

Broker-dealer libraries, templated newsletters, and copy-and-paste social posts are everywhere, which means they no longer differentiate anyone.

Prospects can spot generic content instantly. And when every advisor is sharing the same article, the same headline, or the same “market update,” the message gets lost.

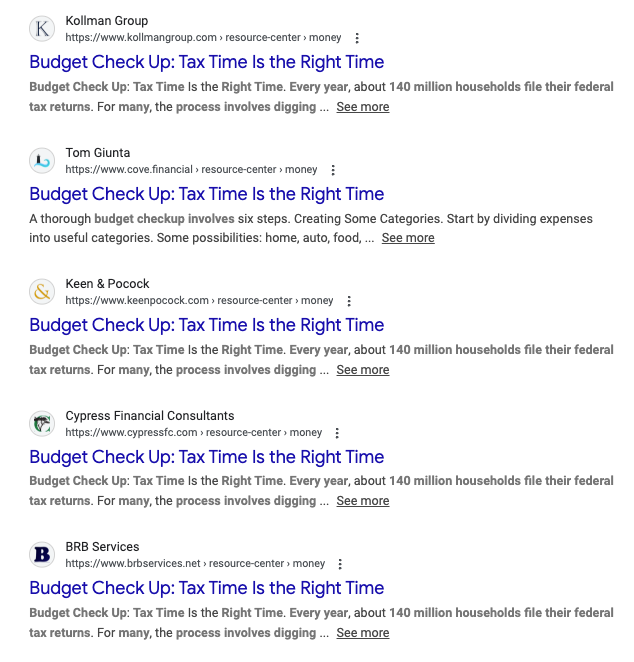

Just look at what one Google result page looks like for firms using the same exact FMG Suite-provided resource content:

In 2026, financial firms and wealth managers need to prioritize personalized content, even within compliance frameworks:

- Advisor-written intros to approved content

- Firm-specific perspectives and explanations

- Messaging that reflects real client conversations

- Content that sounds like you, not a template

Compliance-friendly does not have to mean generic.

A strong financial marketing agency helps you customize messaging while staying compliance-ready, without stripping your voice away.

4. Consistency Matters More Than Volume; Set a Sustainable Cadence

One of the most common issues in financial services marketing we see is inconsistency.

Firms go through bursts of activity followed by long gaps. From the outside, that feels unstable, even if the firm itself is thriving.

In 2026, consistency will matter more than ever.

That doesn’t mean posting every day. It means:

- Setting a realistic cadence you can maintain

- Showing up regularly with purposeful content

- Aligning marketing efforts across channels

- Building familiarity over time

Consistency builds recognition. Recognition builds trust.

5. Show Your People, Not Just Your Services

Financial services websites are full of jargon. What’s often missing is humanity.

Prospects want to know:

- Who they’ll actually work with

- What your team values

- How your firm operates behind the scenes

This doesn’t mean sharing personal details or being informal. It means going deeper into your brand DNA.

In 2026, firms should focus on:

- Highlighting team culture and values

- Showing collaboration and expertise in action

- Using social media to reinforce credibility and professionalism

- Moving beyond generic service descriptions

People don’t just choose firms. They choose people.

6. Treat Compliance as a Strategic Partner, Not a Limitation

The most successful firms we work with don’t fight compliance. Instead, they design marketing strategies that work with it.

That means:

- Fewer last-minute approvals

- Repeatable content frameworks

- Clear review workflows

- Evergreen educational messaging

Marketing and compliance work best when:

- Expectations are aligned early

- Review processes are clear and efficient

- Response guidelines (reviews, comments, messages) are established

- Content frameworks are repeatable

When compliance is built into the strategy from day one, marketing becomes smoother, faster, and more effective.

This is where the right marketing agency for finance makes a measurable difference.

The Bottom Line

Marketing in 2026 is about being consistent, more human, and easier to trust — wherever your prospects are looking for answers.

If you were our client, we’d tell you this:

The financial firms that win aren’t chasing trends. They’re adapting early and intentionally.

And that’s exactly where smart, compliance-friendly marketing still works best.

Ready to embrace our advice and implement it for your own financial services firm? Start a conversation with our financial services marketing experts today.